- Contact us

- +599-9 461 4545

- info@dcsx.cw

Launch Online Application Portal CW ISINs

Miércoles Bursátiles de las Américas 2021 – Free Webinars

October 5, 2021

2021 Annual Private Wealth Latin America & The Caribbean Forum

October 20, 2021Launch Online Application Portal CW ISINs

The Dutch Caribbean Securities Exchange (“DCSX”) approved as National Numbering Agency for Curaçao by the Association of National Numbering Agencies (“ANNA”) as of June 17, 2021, is happy to announce on October 4, 2021, the launch of its online portal for the application of Curaçao International Securities Identification Numbers (CW-ISINs).

About the CW ISIN

The International Securities Identification Number (ISO 6166) is the recognized global standard for the unique identification of financial instruments. ISINs are used to identify most types of financial instruments, include equity, debt, and derivatives.

The ISO process, the resulting identifiers, and the long-term governance standards are used by every business sector, because of their characteristics of ethical integrity, commitment to open communications, and the continuing involvement of the businesses affected. The International Securities Identification Number (ISIN), and the Classification of Financial Instruments (CFI) that are assigned by the national numbering agencies are part of a larger family of financial identifiers known as the ISO-standard identifiers. They identify aspects such as the country and currency in which securities are traded, where they were issued, the names of the issuer and the home-country depository, and the exact type of securities and their terms.

The impact of these ISO-identifiers on the financial industry is immense and ongoing. They have been essential to the ongoing evolution of the entire lifecycle of investment operations. They have massively reduced the time, cost, and risk of cross-border transactions. They provide standards for sharing information among all the entities involved in capital markets operations – investors, asset managers, broker-dealers, exchanges, custodian banks, clearinghouses, depositories, and other specialists.

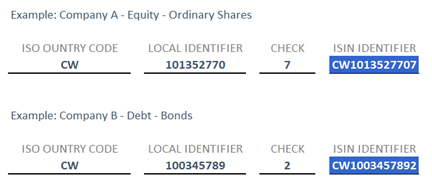

The ISIN code consists of a total of 12 characters as follows:

The first two characters are taken up by the alpha-2 country code “CW” as issued in accordance with the international standard ISO 3166 of the country, Curaçao, where the issuer of securities, other than debt securities, is legally registered or in which it has legal domicile. This is the jurisdiction that the DCSX as the assigned National Numbering Agency has the authority to issue ISINs for.

Overall ISO rules govern the designation of the “CW” Country Code:

- For Equity Issuers: the country where the entity is incorporated must be in Curaçao. In the case of depository receipts, the country code is that of the organization that issued the receipt, rather than the one that issued the underlying security.

- For Domestic Debt Issuers: the country where the lead manager is located must be in Curaçao.

- For International Debt Issuers: the country where the Central Securities Depository is located must be in Curaçao.

The next nine characters are taken up by the local numbering code of the security concerned. Where the national number consists of fewer than nine characters, zeros are inserted in front of the number so that the full nine spaces are used.

The final character is a check digit computed according to the modulus 10 “Double-Add-Double” formula. See in the illustration below 2 examples of the CW ISIN Code.

About DCSX and ANNA

The Dutch Caribbean Securities Exchange (“DCSX”), established in 2009 in Curaçao, Is a regulated international exchange for the listing, and trading in domestic and international securities. The DCSX is the only authorized Securities Exchange in the Dutch Caribbean licensed by the Minister of Finance and supervised by the Central Bank of Curacao and Sint Maarten who is an Associate Member of the IOSCO.

The DCSX was approved as a Partner of the Association of National Numbering Agencies (“ANNA”) and as National Numbering Agency for Curaçao on June 17, 2021. The approval took place during the Ordinary General Meeting held in Frankfurt Germany.

ANNA is a global association of national numbering agencies with a common mission: to provide reliable, accurate, and trusted means to identify and describe securities that can be used by all nations and their markets. This is done through ISO-standard identifiers. ISO-standard identifiers have become the common language of financial transactions and processing around the world because they are developed by the financial industry itself, under processes established by the International Organization for Standardization (ISO).

Although ANNA and the global identifiers have existed for more than two decades, the work and excitement of bringing new numbering agencies online is a constant reminder of why this work is so important. Every country that takes on the responsibility of issuing globally standard identifiers accomplishes much more than only associating codes with aspects of an investment instrument. This step enables investment capital to flow easily across borders. It facilitates modern automated exchanges and trade settlements. Last but not least, each nation that participates in the common financial language adds to and profits from a global understanding of opportunity and risk in the markets.

In taking responsibility for assigning these identifiers, the members and partners of ANNA meet strict and detailed standards in how they register the securities and keep the data current, in their business practices in serving issuers and users of the identifier, and in the group requirement to keep standards and practices current with changing market conditions. In all of this, ANNA provides a formal framework for support, education, technical and operational solutions development, and representation to financial and regulatory forums. ANNA also operates the ANNA Service Bureau (ASB) to consolidate the identifiers from around the world and provide a single point of access for users who may need regular feeds of new and updated identifier information. ANNA also has a second role in servicing the financial community at large as the Registration Authority for the ISIN standard. ANNA is responsible for monitoring the national numbering agencies for compliance with standards in business operations, technology, and data quality, as well as providing assistance to agencies in difficulty.

Applying for a CW ISIN online

The DCSX online application portal is used to submit requests for the assignment of DCSX identifiers for new or existing issuers incorporated in Curaçao. The identifier request system uses an advanced technology platform that expedites the assignment process and permits the timely return of ISINs to “Requestors.”

The DCSX online application portal is used to submit requests for the assignment of DCSX identifiers for new or existing issuers incorporated in Curaçao. The identifier request system uses an advanced technology platform that expedites the assignment process and permits the timely return of ISINs to “Requestors.”

The application form and accompanying electronic documentation are all that is needed to complete the request.

The DCSX issues CW ISINs for the following type of securities:

EquityOrdinary Shares Depository Receipts Exchanged-Traded Funds Mutual Funds Limited Partnerships Single-Stock Options Preferred Shares Real Estate Investment Trusts Unit Investment Trusts Rights Warrants

|

DebtAsset-Backed Securities Bankers Acceptances Certificates of Deposit Collateralized Debt Obligations Commercial Paper Corporate Bonds Medium-Term Notes Mortgage-Backed Securities Municipal Bonds Structured Products Syndicated Loans

|

Required Documentation

Documents required include:

- Prospectus/Private Placement Memorandum/Information Memorandum.

Important Note: The requestor can provide an initial draft of these documents with the application but should provide the final version to finalize the issuing process.

- Excerpt from the Curaçao Chamber of Commerce.

Important Note: The requestor can provide the online version of the excerpt with the application, but the original (stamped) version of the Excerpt from the Curaçao Chamber of Commerce not older than 12 months is required to finalize the issuing process.

- Articles of Incorporation.

The Process

Requestors will receive an initial email confirming the receipt of the request. Next, the requestor will receive an email from our administration department with the invoice for the ISIN application fee.

The issuing process will be completed upon the receipt of the proof of payment (the application fee is 200USD excluding 6% turnover tax) and the final documents.

Without receipt of the final documentation within 10 days of the offering date, the DCSX reserves the right to suspend and/or withdraw the ISIN code request.

The DCSX will perform the review of received documents when proof of payment is provided.

Upon completion of the issuing process, the requestor will receive an email confirmation with the allocated ISIN. Along with the ISIN, the requestor will also receive a designated Classification of Financial Instruments code (CFI), and a Financial Instrument Short Name (FISN).

Ongoing Obligations

The DCSX requires the requestor to inform the DCSX of any significant corporate action related to the entity incorporated and/or located in Curaçao that occurs after the issuance of the ISIN. Examples include but are not limited to mergers and acquisitions.

The DCSX has the obligation to request supporting documentation for the reported corporate action. Examples include signed proxy statements, shareholders’ and directors’ resolutions, updated articles of incorporation, or any other relevant documentation supporting the corporate action.

Listing on the DCSX

The above-mentioned online application process is not necessary for entities established in Curaçao that are not listed yet on the DCSX but are newly applying to list on the exchange. In these cases, the ISIN services will be provided by the exchange for free as the ISIN application will be part of the listing process.

Entities that are planning to list but still need some time to complete the information memorandum and or collect all required information can apply for a stock code reservation with a cost of 500USD, assuring them the availability of that preferred stock code for a period of 6 months.

The above-mentioned ongoing obligations to maintain the CW-ISIN will remain applicable in case of a voluntarily delisting or listing cancellation by the DCSX.

The ISINs for Curaçao based entities have been issued by the national numbering agency CUSIP Global Services (“CGS”) prior to October 1, 2021. Since October 1, 2021, the exchange is officially open to receive requests for ISIN applications for Curaçao based entities. To access our ISIN plication portal click here