- Contact us

- +599-9 461 4545

- info@dcsx.cw

Bridging Financial Innovation and Regulation Seminar

Listing Celebration EoM N.V.

June 18, 2018

Present Your Startup Caribbean 2018

August 31, 2018Bridging Financial Innovation and Regulation Seminar

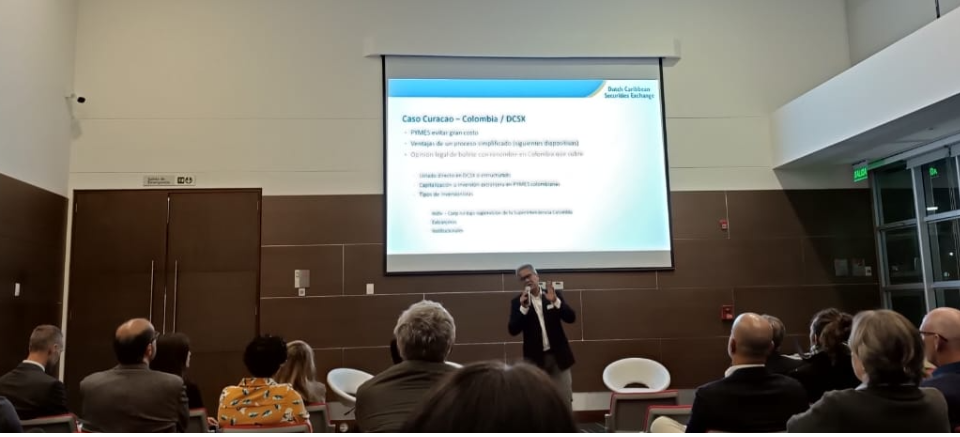

The 2018 Bridging Financial Innovation and Regulation Seminar was held on June 28 and June 29, hosted by the Centrale Bank van Curaçao and Sint Maarten (hereafter “Central Bank”). New technologies are arising and generating new opportunities for new business models to emerge. There is a strong need to understand these new opportunities. Events such as this seminar provide a platform where several speakers come together to discuss and elaborate on these new opportunities. But it is also important to acknowledge the Central Bank and its willingness to listen to propositions regarding innovations.

The seminar started on the first day with welcoming words from the acting president of the Central Bank, Mrs. Leila Matroos, and stated that we should be able to navigate through new technologies while still complying with rules and regulations in order to do so we should be able to understand new technologies.

The Minister of Finance, Mr. Kenneth Gijsbertha, elaborated why it is important to be in favor of bridging innovation, be able to work with partners in the region while ensuring a higher level of inclusion and productive participation, and having an open mind approach in order to attract international investors.

Oliver Rikken, Blockchain, and Smart Contract Expert provided information about Fintech and artificial intelligence mainly focusing on Big Data Analytics, Open Banking, and the Blockchain. About the Blockchain, Mr. Rikken provided an extensive explanation of the difference between Blockchain (the network or database), Bitcoin (the protocol or software) and bitcoin (the cryptocurrency). He briefly explained the difference between a cryptocurrency and a token and elaborated on smart contracts which are based on a code deployed on the Blockchain and are used as bank accounts.

Ryan Peterson, General Manager Economic Policy Centrale Bank van Aruba (CBA), elaborated on how to navigate the strait of regulatory innovation and the importance of change and creating pro-innovation Fintech regulation. An important give away from his presentation is the idea to invite the legislator/regulator and the innovator to sit together at the table to work in our organizations.

Jerry MacArthur Hultin, Chair, and Co-founder of Global Futures Group, LLC, elaborated on Smart Cities, the use of data and information to learn and offer a better quality of life. He provided specific examples of how this can be applied on the island. First, we should create a platform that supports innovative ideas in order to create smart cities. Courses such as programming, video, data analysis, application development, advanced manufacturing, innovation, and entrepreneurship should be taught in universities form the start to prepare students to contribute to innovation.

The first day ended with the presentation of Paul Andrews, Secretary General International Organization of Securities Commissions, who elaborated on how innovation is impacting financial markets and whether there is a new paradigm for Central Banks and Securities Regulators. Regulators should put the focus on enabling technologies into the market.

The second day of the seminar started with welcoming words from the acting president of the Central Bank, Mrs. Leila Matroos, where she reiterated the importance of understanding new technologies.

Gabriel Abed, Founder, and Director of Bitt Inc. presented the concept of Central Banks Digital Currencies and how this was applied in Barbados.

Bradley Holt, Developer Advocate and Senior Software Engineer with IBM Watson Data Platform, elaborated on the different type of apps that can be developed from native apps, to hybrid apps to progressive web apps.

Jerry MacArthur Hultin, Chair and Co-founder of Global Futures Group, LLC, discussed the concept of smart cities and reiterated the importance of taking action towards innovation.

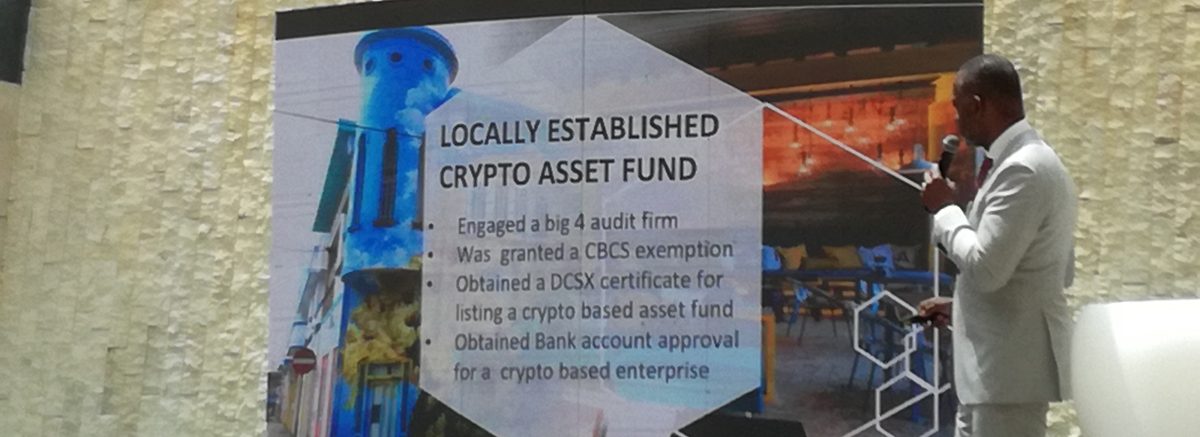

The Minister of Economic Development, Dr. Steven Martina, provided a presentation on the different aspects of Smart City and how that can be accomplished with the collaboration of the private and public sector. In regard to Blockchain and cryptocurrencies, he shared the results of a white paper prepared by the Curaçao Blockchain Cryptocurrency Taskforce (CBCT). There is much work to be done in this area, for example, determine how digital assets should be treated and contemplate the possibility to establish a Dutch Caribbean Token Exchange (DCTX) which doesn’t seem that farfetched since we already have the Dutch Caribbean Securities Exchange operating locally and internationally.

It is also important to acknowledge what has been accomplished already in the arena of Blockchain and cryptocurrencies. Curacao has the first Crypto based Fund that received an exception from the central bank, a DCSX certificate indicating the listing approval, has opened a bank account and is being audited by one of the big 4 audit firms. 120 students from the University of Curaçao successfully completed the Blockchain course and in September 2018 the courses of Blockchain developer and Smart Contract developer will be provided to students with opportunities of scholarships.

The seminar continued with Robert Toomey, Managing Director and Associate General Counsel at SIFMA, who elaborated on the dynamic trends in Fintech innovation and what they mean for regulators and market development.

Jason Mahoney, Special Counsel at Office of International Affairs of the U.S. Commodity Future Trading Commission (CFTC), provided insights into the CFTC approach towards virtual currency being more proactive in going out to universities and seminars and providing educational material on the subject matter.

Errol Cova, Head of the Investment Institutions and Trust Supervision department from the Central Bank, presented the bank’s point of view with regards to Fintech/Regtech developments and acknowledges the importance of working together with other stakeholders and the willingness of the bank to do so. Change for the Central Bank may mean being less conservative, which is a difficult task to do for an organization, that exist 100+ years being conservative. However, there is a willingness to listen to new ideas and propositions.

The seminar continued with a discussion panel where the presenters of the 2-day seminar came together to answer questions from the public. After the panel disunion, the seminar ended with a cocktail event.

We should take a moment to realize the importance of such events in current times of change. As new developments are constantly arising, we should be able to keep up or at least track these changes. It is very important to be prepared as much as possible for these changes as organizations. The Central Bank is willing to listen and we should take advantage of this opportunity to talk with them and the innovators within our companies to discuss new ideas. Just take a moment and remember the timeline of audio formats, from long play record, to cassette tapes, to CDs, to now Mp3 and Mp4 and that available online. The companies that didn’t change their business models disappeared so taking action is required in order to prevent becoming obsolete in this rising technological era. Taking action requires looking for resources, in most times they are financial resources that are required to make that business idea a reality. Financial recourses can be obtained by raising capital on the DCSX through an equity listing, fund listing or a bond issuance. Contact one of our listing advisors < https://www.dcsx.cw/listing-advisors> for more information.