- Contact us

- +599-9 461 4545

- info@dcsx.cw

FinTech: Hype or What?

The Stock Market Vs. The Bond Market: Who Wins?

December 29, 2020

The ABCDs of FinTech

April 12, 2021FinTech: Hype or What?

Publication 1. 2021

FinTech has been a very popular term in recent years. Depending on the level of your understanding, you may have a sound knowledge of what FinTech is already or you may be completely oblivious to it. For someone who does not have the slightest idea what this is, FinTech may sound like the name of a data server management company or some software development company. In this publication, we will look into the popular FinTech phenomenon.

About FinTech

FinTech is an abbreviation of Financial Technology. As the word eloquently depicts, financial technology is the use of technology by organizations or institutions to take care of their digital financial endeavors and processes. More specifically, we are talking about “new” technology. For a small company, the use of budgeting and payroll apps are examples of FinTech. For a large company, perhaps a whole department could be dedicated to utilizing FinTech and the technology used could be complex and sophisticated like blockchain-based processes and full mobile banking.

One of the major misconceptions that could lead to an improper interpretation of this article is that the word ‘financial’ would only refer to banks. This needs to be rectified. Banks are a small part of the financial sector. For the rectification of this misconception and for similar reasons, let us steer clear of the topic of banks only so that we can have a clear and concise understanding of the general and generic uses of FinTech.

We can find several definitions of FinTech on the internet from several institutions including Investopedia, the International Monetary Fund, and the Financial Stability Board. The definition from the Financial Stability Board is very interesting if we want to understand the general uses of FinTech: “ FinTech is defined as Technology-enabled innovation in financial services that could result in new business models, applications, processes or products with an associated material effect on the provision of services.”

FinTech Transformation

It has not been long since technology has become such a vital part of our lives. The 21st century brought with it a monumental dependence on technology. Machines, vehicles, and even the way of doing business, all depend on technology to properly function. FinTech transformed from being almost non-existent to becoming the oxygen of companies nowadays.

FinTech is an example of how new technologies changed our environment. First came the idea of having paperless environments. Businesses with daily transactions that were recorded in a sturdy ledger were now recording such transactions digitally. Microsoft Word replaced handwritten documents, Microsoft Excel replaced ledgers, and numerous other digital processing tools subsequently slowly took complete control over computing, data collection, data management, digital payments, information retrieval, and storage to name just a few.

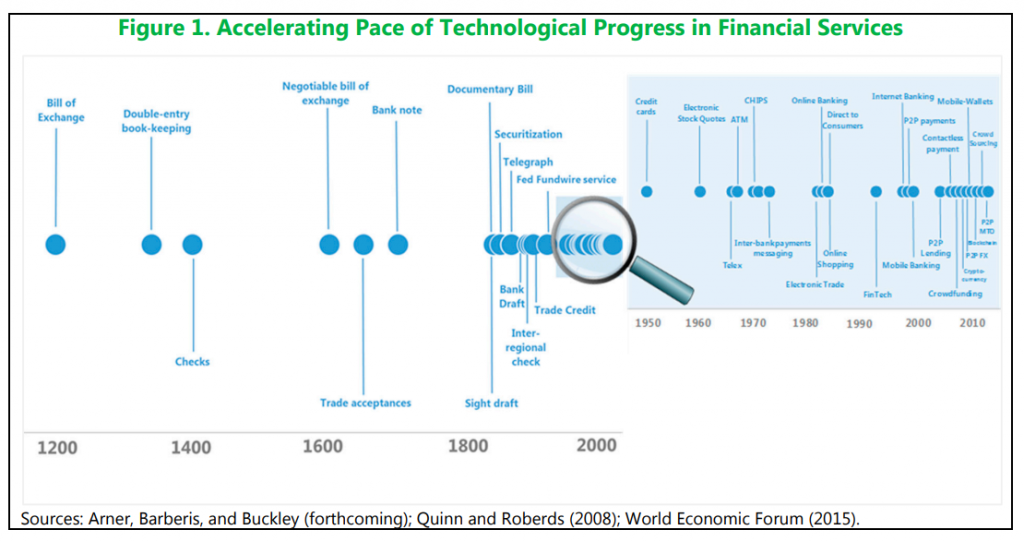

As illustrated in Figure 1, recent years have witnessed a rise in automation, specialization, and decentralization, while financial firms have found increasingly efficient and sophisticated ways of leveraging vast quantities of consumer and firm data (IMF Staff Discussion Notes, 2017):

While it remains an entirely different debate whether certain technological advancements are good or bad, we can see for ourselves some benefits that FinTech has created for the financial sector:

- Ease in recording financial activities;

- Safely recording data;

- Improved Management of historical records (clouds, servers).

- Systematic approach to digital payments.

The use of FinTech can be seen more and more the bigger a company is and goes beyond the financial sector. Small businesses can still make it through the day with simple means of financial accounting but large corporations with many employees would need efficient large data management and record-keeping systems. FinTech helps business owners and even governments in managing their business processes in an accessible manner. Think of the public sector using the distributed ledger format, popularly known as blockchain, for digital currency/payments, land registration, identity management, supply chain traceability, health care, corporate registration, taxation, voting (elections and proxy), and legal entities management,

Opportunities and Challenges

Did FinTech simply slide into all the organizations simultaneously?

It most certainly did not. Adopting these FinTech methodologies took time. Organizations and the parties concerned with adopting FinTech faced certain challenges and opportunities.

Opportunities

FinTech is all about innovation and where there is innovation, there is opportunity. For companies in general, the opportunities mostly included utilizing these new methods to excel in their service level and grow revenues. For some companies, opportunity means a completely different thing. They used the popularity of this concept as a way of creating various new digitized services causing the rise of TechFins. TechFins are the result of rebuilding, improving, or upending the existing financial system with FinTech technology.

Challenges

Important concepts we must keep in mind when discussing challenges are on the one hand ‘flexibility’ and on the other hand ‘rigidity’ in organizations. Flexibility with regards to organizational psychology refers to the readiness a company shows when adapting to change. A flexible company can adapt to situations and bring innovation in its dynamics according to its needs. An example of flexibility is that if a company has decided to shift from a paper-environment to a paperless environment, flexibility demands that it should be done easily and swiftly and with full commitment from all involved.

However, there are also cases where on the contrary of flexibility there is a certain rigidity within in a organization. And here is where the challenge lies. Some companies are rigid. Often, rigidity can be due to difficulties arising in bringing the change about which is then mostly related to the company structure and culture. If we talk about a government department working in different areas at once, such as the Police Force, we can see that a major change would be difficult to bring due to the sheer size of the network of the department and its interconnectivity with several other Governmental Departments. Similarly, FinTech in general also posed such challenges. Big companies could of course not simply put their old records away and start “typing away” instead. There had to be a proper shift and a proper transfer of the old data. This created the necessity for yet other FinTech solutions. The new system had to be properly implemented to not disrupt the business. So, to summarize we see the main challenges of FinTech as the following:

- Difficulty in implementing FinTech software;

- Lack of familiarity between the workers and the software;

- Potential for damage and loss of information/data;

- Mistrust due to the lack of clear regulations.

FinTech Forms changing the Financial Sector

After discussing the opportunities and the challenges, let us look at what FinTech does for the financial sector. FinTech brought with it a revolutionizing way of keeping track and managing the financial activities of a company and altered issues like raising capital and customer management.

FinTech provided immense ease in among others recording and analyzing finances for an organization. By using various data entry software, records could be easily made and saved. Furthermore, by using charts and other sorts of data representation tools, business owners can now analyze the changes in their monetary/financial status and use the analysis to gauge not only their current situation but also create more realistic budgets. Business owners can analyze their financial activity and make much quicker improvements in the workings from within the company. Analysis is a major aspect of financial accounting which in turn has become an ever more important tool for adequate management of a business. In addition, to data management and recording FinTech also facilitated capital raising by modernizing the crowdfunding concept into digital crowdfunding: it is just easier to invest as a Crowdfunder in a project if the whole process has been “FinTeched” online.

Some people argue that maybe the most important aspect in FinTech is safety. This advantage, safety, resides in a lot of technological advancements in general. Saving everything you have in data on a virtual cloud is safer than “hard”-storing something in cabinets in a storeroom, or even your own servers in your own building, especially when environmental factors can easily affect the physical forms of records. For different institutions, companies, and firms, this is manifested in different ways. The advantage resides in the security build within and around the technology and innovative storage and trading/processing platforms. Clearly one needs properly established protocols and risk management policies to maintain this safety.

Overall FinTech has changed the financial sector by virtue of its innovative approach and has rendered once-arduous tasks much easier and more dependable when it comes to accuracy.

The Road Ahead: Rethinking FinTech

We have seen some of the changes FinTech has brought to us until now. But what can we expect in the future?

Innovation births opportunities and FinTech can offer a lot of them. Besides the obvious functions of management of financial records/data, FinTech can offer solutions to other industries with for example programs or software that help and aid in the functions related to healthcare, real estate, production, even voting.

So, the road ahead cannot be predicted. When it comes to rethinking FinTech, we cannot change the core function it is used for. We can, however, bring change into the specific programs and the software that are being used to achieve our specific goals. Twenty years ago, we could not have foreseen the situation we are in today. So, can we really tell what another twenty years may bring?

We all know of the popular cryptocurrencies and blockchain technology, that deeply affected the significance of fiat money. Mobile Payments, Digital Banking, Robo-Advising (AI) apps, machine learning are some other forms of FinTech that are rapidly changing the way we do business.

Final Thoughts

In conclusion, FinTech is not just a hype. It is one of the major disruptors of the 21st century. FinTech completely revolutionized the working and dynamics in the financial sector. Shifting everything from manual to digital takes time and during this time, challenges will be faced. The global shift from paper-based to digitized is an unequivocal example of a collective evolution in terms of technology.

There will be challenges and obstructions in the forms of rigidity and non-compliance to change. However, keeping the apparent benefits in view, companies will learn for themselves that stepping forward and adopting new technologies could yield advantages and ease for their businesses.

FinTech has brought new opportunities and functions for the business sector and it remains interesting to see what it will bring next.

Sources

BDO. June 2020. Rethink FinTech: Crisis as an Opportunity- a global perspective. Last retrieved December 4, 2020. https://www.bdo.global/en-gb/insights/global-industries/financial-services/rethink-FinTech

Claessens, S., Frost, J., Turner, G. and Zhu, F., 2018. FinTech credit markets around the world: size, drivers and policy issues. BIS Quarterly Review. Last accessed November 12, 2020.https://www.bis.org/publ/qtrpdf/r_qt1809e.pdf

Dong He, Ross B Leckow, Vikram Haksar, Tommaso Mancini Griffoli , Nigel Jenkinson , Mikari Kashima, Tanai Khiaonarong, Celine Rochon, Hervé Tourpe. June 19, 2017. FinTech and Financial Services: Initial Considerations. IMF Staff Discussion Notes. Last accessed November 16, 2020. https://www.imf.org/en/Publications/Staff-Discussion-Notes/Issues/2017/06/16/FinTech-and-Financial-Services-Initial-Considerations-44985

European Investment Bank. 2019. Blockchain, FinTechs, and their relevance for international financial institutions. Working Paper. Last retrieved December 4, 2020. https://publications.europa.eu/en/publication-detail/-/publication/ae472145-237a-11e9-8d04-01aa75ed71a1/language-en/format-PDF

Financial Stability Board. February 14, 2019. FSB report assesses FinTech developments and potential financial stability implications. Last accessed November 12, 2020. https://www.fsb.org/2019/02/fsb-report-assesses-FinTech-developments-and-potential-financial-stability-implications/

Federal Deposit Insurance Corporation (FDIC). 2017. FDIC national survey of unbanked and underbanked households. Last accessed November 16, 2020. https://www.fdic.gov/householdsurvey/

Federal Reserve Bank of St. Louis (FRED). Economic Data. 2017. Last accessed November 16, 2020. https://fred.stlouisfed.org/series/TTLHH

FSD Kenya. 2009. Mobile Payments in Kenya: Findings from a Survey of M-Pesa Users and Clients. Last accessed December 4, 2020. https://fsdkenya.org/publication/mobile-payments-in-kenya-findings-from-a-survey-of-m-pesa-users-and-agents/

Hamilton, D. 2019. Blockchain Land Registry: The New Kid on the Block. Coin Central. Last accessed December 4, 2020. https://coincentral.com/blockchain-land-registry/

Huillet, M. 2018. China: Central Bank’s blockchain trade finance platform pilots in Shenzhen. Cointelegraph. November 12, 2020. https://cointelegraph.com/news/chinas-central-bank-backed-blockchain-trade-finance-platform-pilot-kicks-off-in-shenzhen

Kagan, Julia. August 28, 2020. Financial Technology – FinTech. Investopedia. https://www.investopedia.com/terms/f/FinTech.asp

KPMG, 2018. The Pulse of FinTech 2018: Biannual Global Analysis of Investment in FinTech. Accessed July 2020. https://home.kpmg/us/en/home/insights/2017/02/the-pulse-of-FinTech-archives.html

Lagarde, Christine, June 20, 2017. Fintech: Capturing the Benefits, Avoiding the Risks. International Monetary Fund. IMF Blog. Last accessed December 4, 2020. https://blogs.imf.org/2017/06/20/FinTech-capturing-the-benefits-avoiding-the-risks/

O’Neal, S., 2018. State-Issued Digital Currencies: The Countries Which Adopted, Rejected or Researched the Concept. Cointelegraph. Last accessed December 4, 2020. https://thebitcoinnews.com/state-issued-digital-currencies-the-countries-which-adopted-rejected-or-researched-the-concept/

Oprunenco, A. and Akmeemana, C. 2018. Using blockchain to make land registry more reliable in India. London School of Economics and Political Science (LSE). December 4, 2020. https://blogs.lse.ac.uk/businessreview/2018/04/13/using-blockchain-to-make-land-registry-more-reliable-in-india/

This publication is presented to you by the Dutch Caribbean Securities Exchange

Written by N. Martina. Edited by D. Intriago and R. Römer.

Download the PDF version of this article: EN