- Contact us

- +599-9 461 4545

- info@dcsx.cw

FinTech vs TechFin: What’s the difference?

The Curaçao Investor Permit Program (CIPP) and the DCSX

May 7, 2021

Understanding the Rise of TechFins

September 6, 2021FinTech vs TechFin: What’s the difference?

Publication 4. 2021

The 2008 Global Financial Crisis was a key driver to the so-called “FinTech” phenomenon that we have experienced over the last decade. Since 2008, this FinTech movement has been driven primarily by emerging startups on a global scale, financed initially by close contacts and angel investors. Fintech companies started offering solutions to solve specific financial services’ problems for consumers through the creation of technical/digital processes and systems.

It did not take long for other large technological and other companies to join the race offering solutions for their customers too through the creation of technical/digital processes and systems. In 2016, Alibaba founder Jack Ma entered the financial services sector in China with the creation of “Ant Financial”. After that, it has been often cited that Jack Ma actually coined the term “TechFin”. TechFin is not just FinTech backwards, but it refers to a financial service provided by a large originally technological company with an established platform and a large customer base.

So, what are the features of Fintech and TechFin specifically? What are the similarities and differences between Fintech and TechFin? What are the opportunities and challenges of TechFin for the investor, businesses/entrepreneurs? In this publication, we will discuss these questions and more.

Features of Fintech and TechFin

FinTech generally refers to the use of technology to deliver financial solutions. A FinTech is typically a startup that identifies a weakness in the financial services chain, a technological area where financial service providers underperform perhaps because of regulatory changes or lack of digital customer focus, and are looking to provide a solution for the problem. The goal is to sell the solution service directly to customers or to an existing financial service provider.

TechFins are different from FinTech. They typically start with 3 key points: technology, data, and customers. They then move into the world of finance by leveraging their access to data and customers and seek to provide better services than the existing traditional service providers and outperform Fintech Startups.

Disrupting the Financial World

Traditional financial service providers, such as banks, usually are more focused on the real banking activities relationship with customers. Only recently did they start to consider supplementing their risk analysis of customers by using more broadly derived data in response to the rapidly changing environment in the financial services industry.

The financial service provider through datafication will be able to have very accurate, detailed, and extensive digitalized information about a customer. This can be further used for analysis to provide the customer with the most personalized service which adds value to customer retention.

Traditionally banks are initially armed with detailed questionnaires and forms completed by the customer on the customer’s financial behavior and history that the bank collects over the years. This seemed to be a valuable advantage in the past. However, to gather the customer’s financial history and over time collecting the customer’s financial behavior, banks may no longer enjoy this advantage, or at least not for long. The data superiority of TechFins comes from information gathered from various sources that combined provide an even more comprehensive, data-based view of their customers’ preferences and behaviors. These data can be collected, for instance, from:

- Software companies providing information about users’ activities such as Microsoft, Google.

- Hardware companies providing information about the customer’s usage behavior and location by utilizing sensors with continuous monitoring such as Amazon’s Alexa.

- Social media services such as Facebook and Tencent providing insight into the social preferences and daily activities of their users.

- Search engines such as Google and Baidu providing insight into online activities.

- E-commerce platforms like Amazon, Alibaba, or major retail chains with large market share, like for example Wal- Mart, provide insight into consumer demand and payment history.

- Telecommunications services providers such as Vodafone and AT&T, provide data on mobile activities.

The amount of information collected, if well analyzed and studied, can potentially describe in detail the state of entire economies worldwide.

TechFins moving further into financial services, the way analogous Chinese corporations like Baidu, Tencent, Alibaba, have done, can relatively quickly assemble much of the information the customer’s bank or asset manager possesses, and supplement it with their very detailed knowledge of many other aspects of the customer’s choices and preferences. These preferences can then be processed through algorithms that have established correlations between certain preferences and creditworthiness, in order to provide a much more nuanced assessment of for instance the creditworthiness of a “user” than anything a bank could do.

As previously mentioned at the beginning of this publication, TechFins sort of originated with Alibaba and continued to grow in Asia. American tech giants did not stay still and also became more active in the financial service industry. They became known as the GAFAs (Google, Apple, Facebook, and Amazon) while the China-based TechFins are called BATS (Baidu, Alibaba & Tencent). It is a long-term battle between the BATS of China and the GAFAs of the United States of America. The China-based TechFins seems to have the upper hand with their large customer base that is ready to consume their products almost instantly. The U.S based TechFins started to emulate the China-based TechFins. For example, Facebook messaging service WhatsApp is beginning to incorporate some similar features of WeChat. Amazon and Google established their payments platform for their customers and third-party vendors interested in using their products. The U.S based TechFins or GAFAs are investing heavily in the ABCD technologies which we have previously discussed in the publication “The ABCDs of Fintech”. The outcome of such intense competition will be an inevitable drastic change in how financial institutions do business. We will discuss their impact on the financial system in upcoming publications.

Opportunities and Challenges of TechFin

Both FinTech and TechFin can financially benefit from technology and are frequently focused on data analysis. FinTech companies are mostly focused on finance first and the application of technology to deliver improved financial services. Detailed data collection and analysis comes later.

Financial institutions have digitized, or are about to digitize themselves, technology companies have been digital, and data-driven from day one. This extends to business models with banks being interested / fee-generating focused on digitizing money. On the other hand, Tech companies such as Google and Facebook are focused on selling information (monetizing data). The digitization of bank processes does not translate into the change of their business model that could make them TechFin companies. In short, a FinTech remains at its core a financial intermediary whilst a TechFin is first and foremost data owner/intermediary that uses these data to see where it can increase its activities to include defacto financial services.

TechFins rely on big data and models/structures developed in their primary course of business and then put them to use in financial services. They may do so by considering, or even providing, the front-end of financial services, for example by being the link between financial intermediary and client. When providing services, they may rely on aggregating huge amounts of data to verify assumptions as to the client’s solvency, payment behavior, savings discipline, and other relevant factors. Overall, for TechFins, data gathering, and analytics are key, beginning with self-developed algorithms that look directly for data correlations, and later advancing to machine learning and AI.

The Monetization of Data

We have often heard people say how recent innovations have made them realize the importance of data. With the rise of TechFin, the value of data increased to the point where it’s fair to compare it to the importance and value of gold, oil, or any known valuable commodity. As such we should not be surprised by the rise of interest of large companies in participating in the financial industry. But how does a tech firm enter the industry?

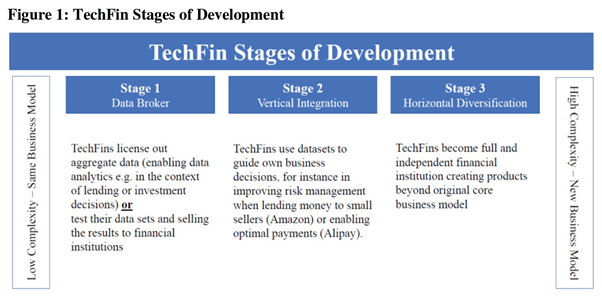

The road for large tech companies to drive into the financial services industry consists of 3 stages:

- First, a tech firm takes advantage of its data-intensive, front-end (i.e., customer connected) business model, either by licensing out aggregate data to incumbent financial institutions or FinTechs (enabling data analytics for example in the context of lending or investment decisions) or, less likely initially, by testing their data sets and selling the results to financial institutions (so that the using institutions can gather information on correlations e.g., Thomson Reuters).

- In the second stage, TechFin uses these datasets to guide its own business decisions, for instance in improving risk management when “providing credit” to small sellers and/or buyers or enabling optimal payments (Alipay, Amazon Pay, and Google Pay).

- In the third and final stage, given the superiority of their data, one can expect some of these TechFins to move into offering financial services and thus move into stage three in which they will provide very stiff competition to incumbent banks and other regulated entities in the financial industry.

Source: SSRN-id2959925

The monetization of data is the process where the party in possession of data sells this to the other party interested. As such all companies in possession of data will take advantage of this “value” to receive a financial benefit like Google and Facebook selling users’ data behaviors to advertisement companies. Seeing that most Fintech and TechFin companies in possession of data gathered it for free from their users the question raises if it is crazy for the user who provided that data that the company uses to gain profit to ask for some sort of dividend or compensation? In principle, it does not sound so crazy. As the owner of the data, the user could obtain compensation/dividend for the use of its data. At the moment, there isn’t a proper structure in place for such a scenario to happen. However, that could easily change in the future if the governments change the legislations and regulations on Big Tech. In the U.S. for example, Tech companies can easily manage and use their customers’ data by adjusting their terms and conditions.

Final Thoughts

Fintech solves a specific financial service problem for customers basically by offering an innovative financial solution or process based on technical possibilities in the form of a new product or service. TechFins incorporate existing financial technological solutions to their business model in various aspects.

The increased value of data makes it attractive for big tech companies to profit from their collected data, and so far, it has been very easy for them to be successful with the implementation of their products based on their large customer base and the advantage they have with customers giving them authorization to use their data by accepting their terms and conditions (which are periodically updated in the benefit of the company). And they usually do not face any initial funding issues when they become TechFins.

Fintech companies usually struggle to obtain funding and rely mostly on angel investors, and financial institutions to obtain most of their initial funding. Crowdfunding has been beneficial for FinTech funding, but it still has its struggles and is still not globally available. Crowdfunding regulations are still an unfinished puzzle for many jurisdictions to figure out how to incorporate it as a financial/funding alternative. And it may take a while for standardized rules to be established for better management of this FinTech solution.

Both Fintech and TechFin are clear disruptors of the financial service industry. Traditional institutions are now basically forcing to digitize their business structure if they want to survive the digital revolution. So far, we have seen that they often become the customers of the Fintech and TechFin companies

Sources

Bangkok Bank Innohub, March 13, 2019, TechFin – the new challenge of the financial world. Last accessed June 14, 2021: https://www.bangkokbankinnohub.com/techfin

Khan. F, August 1, 2018. TechFin vs. FinTech – What’s the difference? Last accessed June 14, 2021: https://www.datadriveninvestor.com/2018/08/01/techfin-vs-fintech-whats-the-difference

Zetzsche, D.A, Buckley, R.P, Arner, D.W and Barberis, J.N. April 25, 2017. From FinTech to TechFin: The Regulatory Challenges of Data-Driven Finance. European Banking Institute Working Paper Series 2017-no.06. Last accessed on June 14, 2021: http://ssrn.com/abstract=2959925

This publication is presented to you by the Dutch Caribbean Securities Exchange

Written by N. Martina. Edited by D. Intriago and R. Römer.

Download the PDF version of this article: EN