- Contact us

- +599-9 461 4545

- info@dcsx.cw

Listings Part 3 – A look into the Listing Process

Playing by the Rules

August 1, 2019

The Case for Bond Market Development

April 20, 2020Publication 10. 2019

Regardless of its industrial sector or country of origin, a legal entity may request a listing on the Dutch Caribbean Securities Exchange (“DCSX”). The listing entails the issuance of securities, such as equities and bonds among others, through a public or private placement. The public placement is popularly known as the Initial Public Placements or “IPO” for short. With an IPO the listed securities are offered to the investment public. A Private Placement on the other hand offers the sale of securities directly to a limited number of outside investors or is limited to the shareholders of the entity which may have to option to buy and sell shares among themselves.

Both offering types, Private and Public, can be categorized as technical or tradeable listings. In the previous publication “Listings Part 1 – Tradeable or Technical; What Does That Even Mean?” we discussed the difference between tradeable and technical. But still the question remains why is a technical listing still interesting for companies, especially SMEs? A technical listing is often chosen for the following reasons:

- To elevate the company profile on the market;

- To elevate the compliance level of the legal entity including the transition to audited financial statements which at the same time is considered a preparation to go to trade-ability in the future on the DCSX trading platform;

The requirements for technical and tradeable differ in the sense that tradeable listings application requirements for Equity, Bonds, or Funds are more extensive compared to the technical listing’s requirements. Technical listings on their part have their particularity as well that shouldn’t be taken lightly.

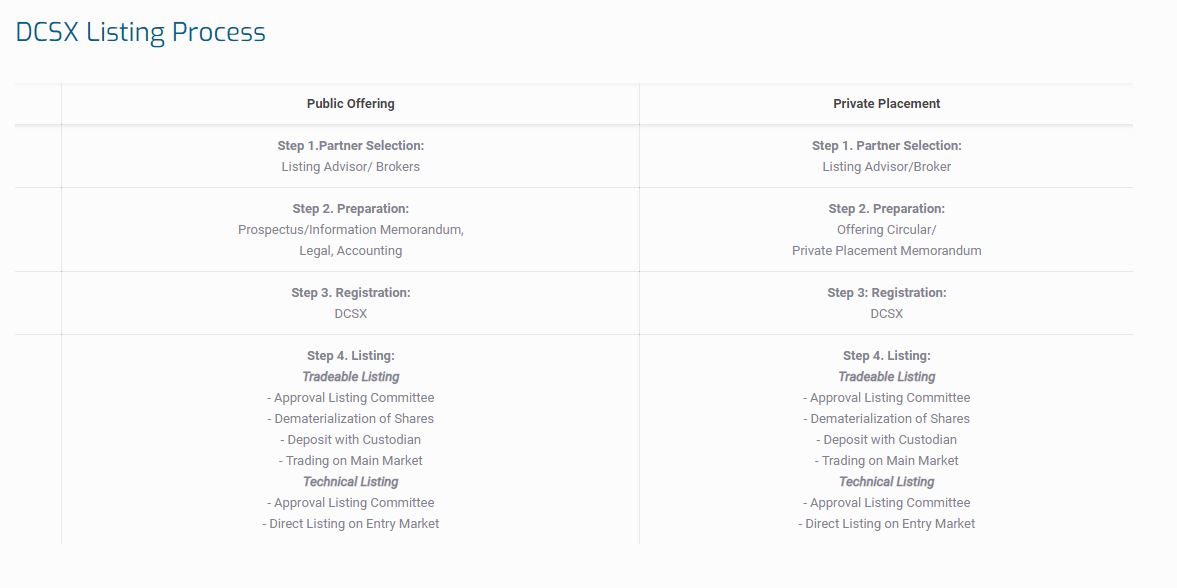

HOW DOES THE LISTINGS PROCESS WORK AT THE DCSX?

There are four main steps to follow:

- STEP 1: PARTNER SELECTION

- STEP 2: PREPARATION

- STEP 3: REGISTRATION

- STEP 4: LISTING

Let’s discuss each step in more detail for better understanding.

STEP 1: PARTNER SELECTION

The legal entity (the issuer) who wishes to list on the DCSX must select a Listing Advisor and a Broker or a set of Brokers. The Listing Advisor acts as coordinator between the issuer and the exchange at all times, both in the process of listing and throughout its life as a listed entity. The listing advisor will be accountable for the correctness of information and compliance with the listing requirements and ensures that the issuer fulfills its transparency requirements.

The Broker will oversee the buying and selling of the listed securities. The Broker together with the Listing Advisor and the Issuer will team up on a roadshow to promote the listing to interested parties. All interested parties/investors must open an account with the broker. Once the listing process is approved and completed the broker will offer access to its trading portal that is connected to the DCSX trading platform to their clients in order to buy and sell the listed securities. Unlike popular belief, the DCSX does not offer direct access to its trading platform to investors. All interested parties must have a brokerage account at the issuer’s selected broker or brokers approved by the DCSX.

There are instances where issuers chose to engage an arranger for the listing. The arranger will work like a planner or coordinator for the issuer in the general sense. Unlike the Listing Advisor, the arranger doesn’t have a direct obligation with the DCSX, other than identification requirements.

The selection and evaluation of the chosen partners are the responsibility of the issuer. The agreements between the issuers and their selected partners including the listing advisor and Broker’s fees remain a private matter between both sides. The DCSX has no say in what its Listing Advisors and Brokers are charging their clients.

STEP 2: PREPARATION

After selecting the right partners, the next step includes the preparation for the listing (Tradeable or Technical). At this stage the Listing Advisor together with the issuer team up to prepare the Prospectus/Information Memorandum (in case of a public offering) or a, Offering Circular/Private Placement Memorandum (in case of a private placement). In both cases, the documents offer detailed information about the company, the securities listed, and the related risks and projections. It is sometimes referred to as a “detailed business plan”. During this stage, the Listing Advisor ensures to request all required legal documents as well as the audited financial statements in accordance with the listing requirements. At this stage, the DCSX not officially involved yet. It is up to the Listing Advisor to ensure everything is ready in accordance with the requirements to start the application/registration process.

STEP 3: REGISTRATION

When all required documentation is complete, these are sent together with the application letter/forms to the DCSX for registration and processing of the application. The DCSX will internally review the received documentation and provide feedback to the Listing Advisor indicating whether the received documents are in line with Local Requirements and International Directives.

STEP 4: LISTING

If the received documents are in line with the DCSX requirements including the final version of the Information Memorandum, the DCSX then proceeds to send the documentation to the Listing Committee who will review the documentation on their part and provide inquiries which must be addressed by the Listing Advisor. If the received feedback is satisfactory for the Listing Committee then approval will be granted for the admission to list or trade.

Technical Listing

Once approval is obtained for a technical listing, it can be directly listed on the platform.

Tradeable Listing

For a tradeable listing, the process will require a few additional steps in order to receive approval and start the official trading. These include a funding phase where the roadshow to private and institutional investors will take place, the dematerialization of the to be traded shares, and the deposit of said shares with the custodian. Only then, will the listed securities be ready for official trading on the approved marketplace. At this point, all interested investors, with a brokerage account at the issuer’s selected broker, which is DCSX approved, will be able to trade or invest.

The listing process is structured in such a way that it allows a cost-effective process to take place while ensuring certain standards are met to ensure investors’ confidence. As we mentioned before in our previous publication “Playing by the Rules” we understand the desire of Listing Advisors to deliver immediate results to their clients but it goes hand in hand with the quality of the initial delivery. Much time is spared when you deliver the documents as expected and as complete as possible from the get-go. All the time spend going back and forth during step 2 and step 3 can be saved. On the DCSX part Step, 3 and Step 4 are often finished in a maximum of 3 to 4 weeks depending on the quality of documentation received.

During their lifetime as listed entities, companies are required to communicate to the DCSX key information to the market a/o investors. This includes interim internal but also (audited) annual statements, group management discussions and analysis, and in general any information that is of “material importance” for the investor. All this communication is done through their selected DCSX approved Listing Advisor and serves to keep investors and the market in general sufficiently and transparently informed on the overall situation of the issuer.

This publication is presented to you by the Dutch Caribbean Securities Exchange

Written by N. Martina. Edited by D. Intriago and R. Römer.