- Contact us

- +599-9 461 4545

- info@dcsx.cw

Miércoles Bursátiles de las Américas – Session 2

Miércoles Bursátiles de las Américas – Session 1

September 4, 2020

DCSX @ The Virtual Island Summit 2020

September 11, 2020Miércoles Bursátiles de las Américas – Session 2

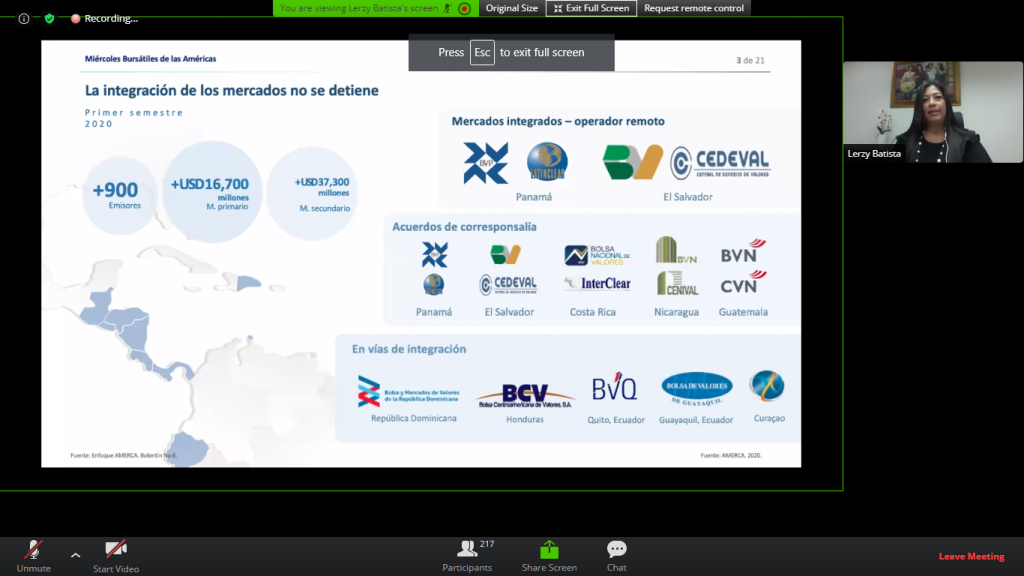

The second session of the webinar series Miércoles Bursátiles de las Américas organized by AMERCA took place on Wednesday, September 9, 2020, titled “Cross-Border Operations and Opportunities”.

Local capital markets often do not meet the demands of institutional investors and in the same way, issuers require fresh capital that they cannot find locally, for this reason, correspondent or integration agreements are essential for their growth. This session explored the experiences of those who have already taken advantage of these mechanisms and how to carry out this type of transaction.

Mr. Gustavo Monge, Gerente General at Interclear Central de Valores, elaborated on the cross-border clearing process Interclear has worked with, based on the regulation of each jurisdiction, like Costa Rica for example. This opened the door to a mass of major investors that entered the main and secondary markets on the local exchange. On a general note, he mentioned the importance of knowing market regulations of the jurisdictions your business wants to work with, study the economy, and look for Investment Advice.

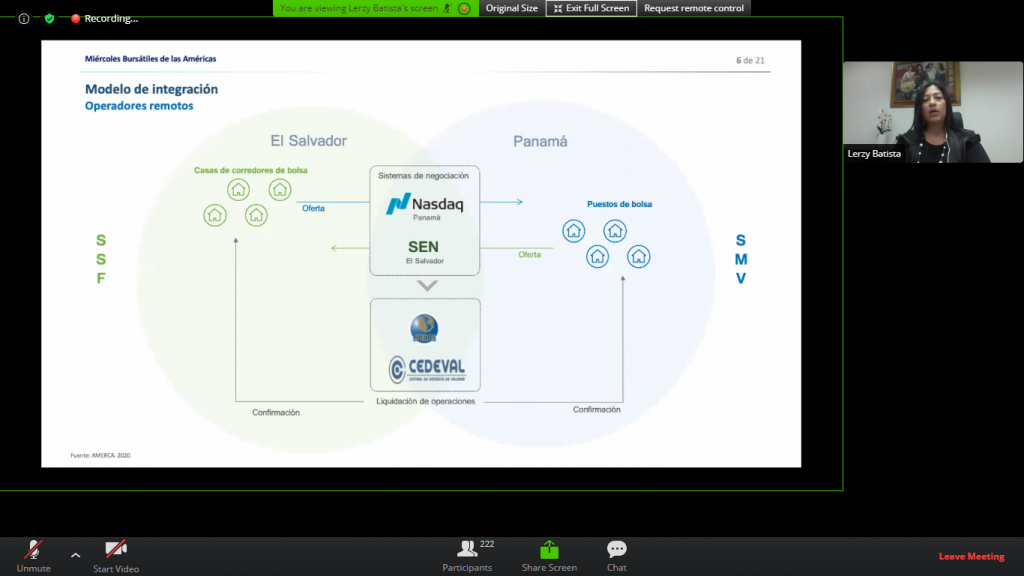

Mrs. Lerzy Batista, Gerente General of LatinClear provided insights into what it means for a clearinghouse to work on cross border operations and the existing models: correspondence model and the direct link model with remote operator.

The model of remote operator requires established agreements for the Correspondence, Custodian & Liquidation activities between the stock exchanges, the clearinghouses/custodians, and regulators to ensure security, trust, efficiency, agility, and business opportunities. The correspondence model facilitates the transfer of funds between Country A and Country B. In most cases, clearinghouses such as Latin Clear have agreements with regional banks to facilitate the movement of funds.

She discussed how AMERCA contributes to the integration of Capital Markets in the region by teaming up with rating agencies, clearinghouses, and custodians. Reaching the goal of Capital Market integration in the region is up to each AMERCA Member. There are guidelines established by LatinClear to facilitate the operational procedures for cross-border operations.

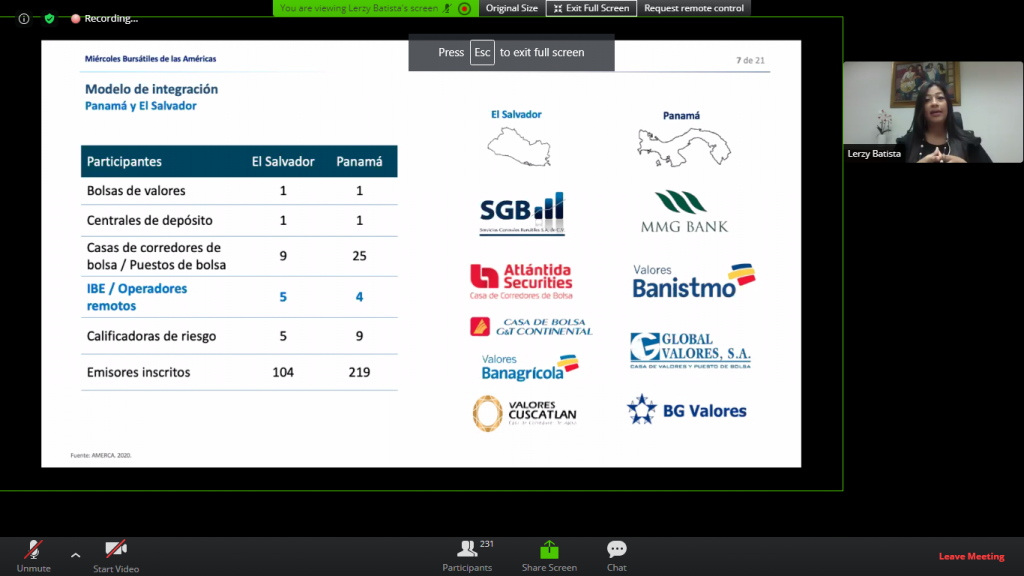

The Stock Exchanges of Panama and El Salvador have reached the goal of capital market integration. What this means is that individual and institutional investors in El Salvador could invest through their local exchange in listings on the Panama Stock Exchange and vice versa.

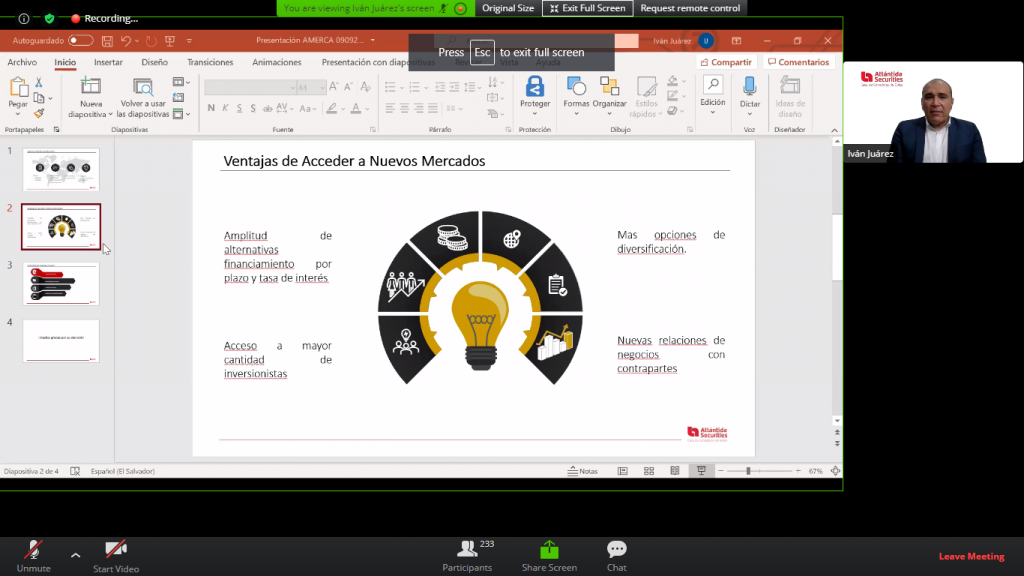

Mr. Juan Juarez, Gerente General of Atlantida Securities discussed the business model of his company and their experiences working with the Stock Exchange of El Salvador and with their local clearinghouse and custodian Cedeval. Atlantida Securities is a Casa de Corredor De Bolsa which is the Latin equivalent to what we know as Listing Advisor and Broker combined.

The next session of Miércoles Bursátiles de las Américas will be on Wednesday, September 16, 2020, at 9:00 am, Guatemala Time, which is equivalent to 11:00 am, Curaçao Time with the topic “The Impact of the Capital Markets on Economies”.

The presentations will be provided in Spanish by Mr. Gerardo Argüello (Gerente General, Bolsa de Valores Nicaragua), Mrs. Maricruz Aparicio, (Gerente General, Bolsa Centroamericana de Valores de Honduras), Valentín Arrieta Whisonant (Gerente General, Bolsa de Valores de El Salvador) and Mr. Iván Carvajal Sánchez (Gerente de Planificación Estratégica y Mercados, Bolsa de Valores de la República Dominicana).

This is a unique opportunity for the financial sector of the Dutch Caribbean to arrange business meetings with peers from Ecuador, Panama, Costa Rica, Nicaragua, Honduras, El Salvador, Guatemala, and Santo Domingo. Exchange knowledge, ask questions and provide insight into your business to find business opportunities. Participation in these meetings is only allowed to collaborators from the different sectors of the financial/capital markets, the general public will not have access.

The business roundtables will be held on September 16, and 23 and will be open from 10:00 am to 6:00 pm Curacao Time. When you register, you are automatically registered to participate in these meetings. Make sure to register at https://www.amerca.net/es/miercolesbursatiles