- Contact us

- +599-9 461 4545

- info@dcsx.cw

Miércoles Bursátiles de las Américas – Session 4

Miércoles Bursátiles de las Américas – Session 3

September 28, 2020

LEARN2GROW – Free Webinar

November 6, 2020Miércoles Bursátiles de las Américas – Session 4

On Wednesday, September 23, 2020, took place the final session of the webinar series Miércoles Bursátiles de las Américas organized by AMERCA- Asociación de Mercados de Capitales de las Américas. In this last session of the webinar series our Managing Director, Mr. Abedd Hammoud welcomed all participants and introduced the speaker of the day.

The topic of this session “SMEs Financing Alternatives in the Capital Market” was presented by Mr. Jaime Dunn de Avila, President of iBolsa Sociedad de Titularización. The presentation included results from his case study published on August 8, 2019, in the report “Oportunidades para el Desarrollo: Mecanismos de financiamiento para PYMES a través del mercado de valores”.

In various studies and international forums, much has been said about the importance of Micro, Small, and Medium-sized Enterprises (PYMES – pequeñas y medianas empresas) within the economies of Latin America. They are a major source of employment, constitute the majority of operating companies, and have a considerable impact on employment figures of up to more than 60% of GDP in some cases.

The capital market has always been seen as an interesting alternative, but at the same time, unapproachable for SMEs. Only 40% of SMEs get access to traditional financing compared to 76% of larger companies. According to a study conducted by the World Federation of Exchanges, the number of Issuing entities that are classified as SMEs is very low to nonexistent in many capital markets. It is recognized that efforts have been made to increase this number by speaking directly to SMEs, but according to Mr. de Avila, this method has been proven ineffective by the records published by the exchanges of Latin America. The need for financing remains, therefore, other alternatives should be considered by exchanges.

Mr. de Avila proceeded to explain the various financing initiatives that have emerged. These have been classified and organized into four large groups, in order to perform a better analysis regarding their effectiveness and utility:

- Alternative Markets;

- Simplified Regimes;

- Special Purpose Vehicles & Collateral Mechanisms, and;

- Fintech.

These four groups span four generations of financing mechanisms for SMEs from the 1980s to the present. Alternative markets (“first generation”) and simplified regimes (“second generation”) are instruments that seek to simplify procedures, based on the hypothesis that costs and bureaucracy are the main reason why smaller companies cannot access the capital market. In other words, they seek to encourage the “offer of SMEs” in the capital market by facilitating their procedures and reducing their registration and issuance costs.

Based on the recorded data on the struggles of SMEs obtaining financing in Alternative Markets and Simplified Regimes, looking at Special purpose vehicles & collateral mechanism and Fintech, seems to have a higher probability of success.

A promising initiative is (equity) crowdfunding. Crowdfunding allows the raising of capital from a broad base of investors for a project through Fintech platforms. It has been very successful in Europe. However, Mr. de Avila acknowledges that it is very challenging for our region to make it successful because of the no standardized regulations. There are jurisdictions wherein crowdfunding is even forbidden. For it to be successful, governments and regulators would have to establish rules and regulations that facilitate the use of this technology.

The costs of issuance are usually high for local SMEs, but even when they find a low-cost alternative for the issuance, they still must deal with the costs for an administrator, auditor, lawyer, etc. SMEs are simply not able to afford those additional costs to the issuance. On top of that, local SMEs don’t necessarily want to directly deal with exchanges, they just want to make use of the funds obtained from raising capital on the market.

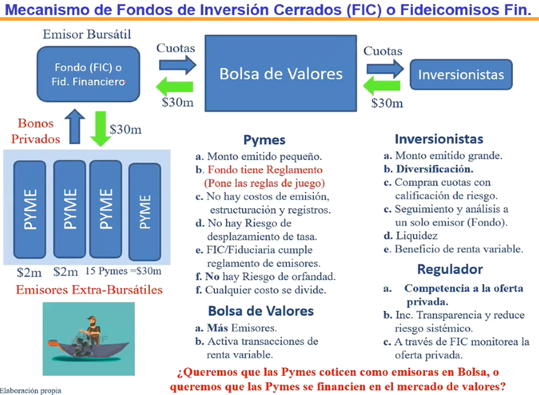

What if instead of having the local SME as the issuer (a company listed on the exchange), you have an Investment Fund Vehicle that invests in SMEs?

The Investment Fund will be the entity listed not the local SME. The Fund will raise capital through the listing for the SMEs it wants to invest in. This is a form of third-generation financing of a Special Purpose Vehicle. The Fund will have to be legally established according to existing laws and registered/approved by the regulator. It will have the responsibility to set up rules and regulations for its portfolio of SMEs.

Graphics Presentation Mr. Jaime Dunn de Avila

The SME will have to follow the rules of the Fund in order to be considered as an entity they would like to invest in. In this case, the SME will not deal with the rules and regulations of the exchange but those of the Fund, which is a very significant difference compared to the case where they are the direct issuers. There are already rules, regulations, and structures in place for this type of initiative.

For exchanges, it is just a matter of being proactive and take action by arranging discussions with the government, regulators, and Fund & Trust Management Companies. Based on the data studied by Mr. De Avila, this option is a great opportunity for regional exchanges to make a significant change and positively contribute to their local capital markets.

Mr. José Rafael Brenes Vega, Managing Director of the Bolsa Nacional de Valores de Costa Rica and President of AMERCA closed the last session of Miércoles Bursátiles de las Américas thanking all attendees and inviting everyone to make the most out of this opportunity and to remain connected.

Links to the previous sessions:

Session 1 Impactos del Covid-19 en la Región de Amerca.

Session 2 Operaciones Transfronterizas. Oportunidades.

Session 3 Impacto de los Mercados de Capitales en las Economías