- Contact us

- +599-9 461 4545

- info@dcsx.cw

Staatsolie US$150million Bond Issuance Approved

Tradeable Listing Approval for Yuquan International Limited

January 31, 2020

Technical Listing Approval for High Fidelity Fund Limited

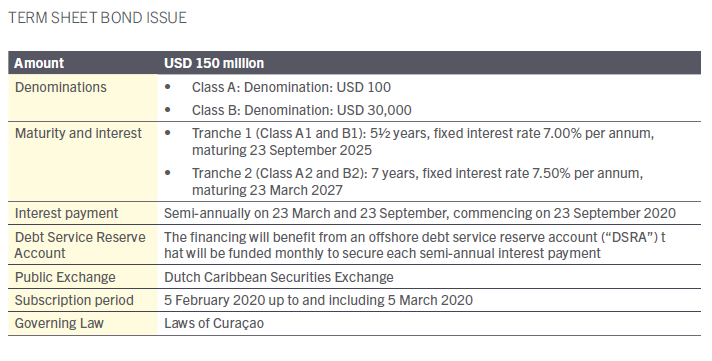

February 5, 2020The DCSX is happy to announce that last January 28th, 2020, approval has been granted for the listing of bonds issued by STAATSOLIE MAATSCHAPPIJ SURINAME N.V. with a market value of USD150 Million. The mandated Listing advisor is VanEps Kunneman VanDoorne. The mandated paying agent/broker for Suriname is De Surinaamsche Bank and the mandated broker for Curaçao is Vidanova Bank

Staatsolie Maatschappij Suriname N.V. (hereafter “Staatsolie”) is a limited liability company incorporated in 1980 and domiciled in Suriname. Staatsolie is vertically integrated across the energy value chain and its core activities are crude oil exploration and production, refining, retail fuel distribution, and power generation. In addition to its core business activities, Staatsolie has a 25% limited partnership interest in Suriname Gold Project C.V. (the “Merian Partnership”) in relation to the Merian gold mine (the “Merian Project”). Newmont Goldcorp Suriname, LLC (“Newmont”) is the managing partner of the C.V. with a 75% interest in the Merian Partnership. Commercial operations started in late 2016 and the first full-year production was reached in 2017. Staatsolie also has taken the decision to enter into a 30% partnership agreement with IAMGOLD’s Rosebel Gold Mines N.V. (“RGM”) regarding the Pikin Saramacca gold mining operation (the “Saramacca Project”) for which commercial operations will commence in April 2020. Negotiations to reach an agreement on the terms and conditions of the partnership are expected to be finalized before April 2020.

Staatsolie Maatschappij Suriname N.V. (hereafter “Staatsolie”) is a limited liability company incorporated in 1980 and domiciled in Suriname. Staatsolie is vertically integrated across the energy value chain and its core activities are crude oil exploration and production, refining, retail fuel distribution, and power generation. In addition to its core business activities, Staatsolie has a 25% limited partnership interest in Suriname Gold Project C.V. (the “Merian Partnership”) in relation to the Merian gold mine (the “Merian Project”). Newmont Goldcorp Suriname, LLC (“Newmont”) is the managing partner of the C.V. with a 75% interest in the Merian Partnership. Commercial operations started in late 2016 and the first full-year production was reached in 2017. Staatsolie also has taken the decision to enter into a 30% partnership agreement with IAMGOLD’s Rosebel Gold Mines N.V. (“RGM”) regarding the Pikin Saramacca gold mining operation (the “Saramacca Project”) for which commercial operations will commence in April 2020. Negotiations to reach an agreement on the terms and conditions of the partnership are expected to be finalized before April 2020.

Furthermore, Staatsolie’s subsidiary Staatsolie Power Company Suriname (“SPCS”) has recently become the owner of the Afobaka hydro dam (“Afobaka Dam”) previously owned by the Aluminium Company of America (“ALCOA”) and its subsidiary Suralco. The ownership of the Afobaka Dam was transferred to SPCS in January 2020 at no cost.

The integrated and low-cost nature of Staatsolie’s oil business combined with investments in gold and power generation creates a diversified revenue base that mitigates cash flow volatility across the commodity price cycle and results in a financial resilience that is rather unique in the industry. Although wholly owned by the Republic of Suriname, Staatsolie is managed independently by a group of highly experienced oil professionals from the private sector with involvement by the Government of Suriname (“Government”) only in accordance with the articles of association of the Company.

Staatsolie seeks to raise USD 150 million. The proceeds of the Bond Issue will be used to refinance the USD 99.1 million, 7.75% fixed interest 2015-2020 bonds of Staatsolie maturing in May 2020 (“Staatsolie Bonds 2015”). The remainder (also referred to as ‘external debt (new)’ in Table 1) will be used to fund the Investment Program 2020-2027 including the Saramacca Project. In the event of oversubscription, proceeds will subsequently be allocated to accelerate the execution of the Investment Program 2020-2027 and partially prepay the Term Loan. The proceeds from this Bond Issue will supplement internal cash flow and will enable Staatsolie to make the scheduled investments to realize the key objectives of the Investment Program 2020-2027.

In the coming years, Staatsolie expects to have the opportunity to make additional and very profitable investments in oil production, requiring further funding through debt and possibly equity. The Company seeks to get more experience with raising capital on the international market. For this reason, Staatsolie decided to do a first international listing on the Dutch Caribbean Securities Exchange (“DCSX”) in Curaçao. The step towards the DCSX will allow Staatsolie to offer its existing Bondholders base an improved investment instrument that is listed, and therefore more easily tradeable and more liquid. At the same time, it will allow investors residing outside of Suriname the first chance to participate in the Company’s funding program, which will broaden Staatsolie’s investors base. With the listing on the DCSX Staatsolie has it’s first experience with international capital markets.