- Contact us

- +599-9 461 4545

- info@dcsx.cw

The Stock Market and Economic Growth

The Case for Bond Market Development

April 20, 2020

Why Securities Market Development Takes Time

May 4, 2020The Stock Market and Economic Growth

Publication 2. 2020

In the previous publication we talked about “The Case for Bond Market development.” The Bond Market along with the Stock Market share space among other market groups assembled on securities exchange platforms. A Securities Exchange platform is a marketplace for listing of government and corporate-issued securities.

Securities in finance are (often tradeable) financial instruments like stocks, bonds, mutual funds, and other types of instruments. The securities listed on an exchange can be Initial Public Offerings, IPOs for short, or securities sold to or owned by a limited number of investors privately, known as Private Placements.

Both the IPO and Private Placement can be listed as technical or tradeable securities on the Dutch Caribbean Securities Exchange (hereafter “DCSX”). The purpose of technical listings is not to raise capital but to increase a company’s profile on the market and to elevate the compliance level of the legal entity; at the same time, it can be considered as a preparation to become tradeable on the DCSX trading platform in the future. Trade-able listings are what are usually known as “traditional” listings, with the main purpose to raise capital or provide liquidity to the shareholders.

An important feature, an actual distinction to most other exchanges, is that our marketplace is open to traditional financial instruments like bonds, stocks etc., but also for innovative financial instruments like equity-backed Initial Coin Offerings (ICOs).

The choice of our legal name, the Dutch Caribbean Securities Exchange is the most appropriate for our business, since it means we welcome several types of securities approved by the regulator on our platform.

In the previous publication we discussed the opportunities and challenges of the bond market. Now what are those same opportunities and challenges in the Stock Market? How do Stock Markets affect economic growth? This publication will, at a high-level, look into these opportunities and challenges of the Stock Market, and its influence on the capital market and economic growth.

The Opportunities

A robust stock market can lead to economic development by:

- Providing awareness to the public at large about a potential investment.

- Creating an investment pool and allocating resources for beneficial use.

- Tracking investment and strengthening corporate governance.

- Promoting risk management and diversification.

A stock market, that functions at its optimum level, may enhance the opportunity for businesses to explore the capital market and thereby create useful knowledge with beneficial impacts on resource management and production.

The stock markets in general use low denomination instruments to offer ways for investors to diversify their investments and participate in business ventures. The issuer, the company seeking capital, will have to track its success, apply measures to enhance corporate governance, and report to the investors in a transparent way.

Stock exchanges will be able to improve their risk management, increase market liquidity, and hence promote financing for otherwise low liquid investments.

The Challenges

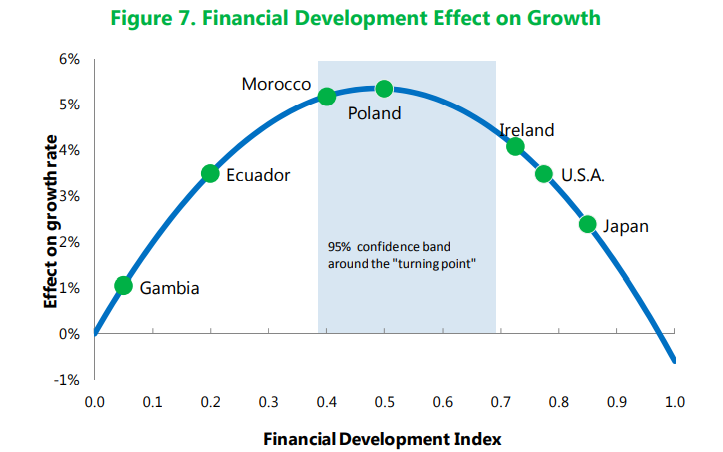

Observations and research indicate that a market can reach a level where it may offer financing that surpasses the need of the market. The graph below shows how there comes a point where too much focus on capital markets reduces growth. This can be seen in the below graph, part of the IMF studies of Sahay et al. (2015) which shows the effectiveness and/or influence of the Financial Development effect on growth based on the relationship between the Financial Development Index (FDI) data and the effect on growth rate.

The Financial Development Index was developed by the World Economic Forum in close collaboration with economists/academics, international financial services organizations, and business leaders, which tries to measure and analyze factors enabling a sound development of financial systems among different economies. The World Bank has created a database for these FDIs.

Source: Sahay et al., 2015 “Changing Financial Heightening: Emerging Market Stability and Expansion,” I.M.F. Staff Discussion Report. Fig. 7.

According to Sahay et al. (2015) “A country to the right of the average “too much finance” range may still be at its optimum if it has above average quality of regulations and supervision; conversely, a country to the left of the range with weak institutions may have reached its maximum already. Broadly speaking, the estimated relationship suggests that a Financial Development index between 0.45 and 0.7 (with 95 percent likelihood) could generate the largest cumulative growth returns (that is, moving from 0 to the growth maximizing point) in the range of 4–5½ percentage points, holding constant other determinants of growth.”

These studies indicate that a too-rapid growth of financial sectors could lead to a loss of efficiency in investments. This may indicate that the quality of finance, for example the allocation of financial resources towards productive activities and human capital across sectors, is negatively impacted at high levels of financial development. In other words, many functions of the financial sector, such as mobilization of savings and transaction facilitation, may remain intact at high levels of financial development; but other functions, such as efficiency in the allocation of capital and the efficacy of corporate control, may begin to break down. This may lead to securities markets’ “bubbles”.

Additionally, ineffective regulation and supervision of business innovation will lead to an increase in economic instability and financial fragility. It can also lead to economic turmoil through an increase in leveraging and unnecessary risk-taking.

The liquidity of the capital exchanges may create a negative impact on corporate governance and promote “myopia” (not really looking at what they do) among investors. This can of course bring significant consequences for economic development because it throws us into a situation of “fear and greed” with focusing on the real financial substance of those businesses that we invest in.

Furthermore, price and acquisition strategies often compensate executives for their financial innovations rather than generating new long-term additional capital value.

Economic Growth and Going Public

Is staying private or going public more beneficial for a firm?

Companies are usually founded as private enterprises, using “owners” or “outside investors” money, free cash flow created from their company, and bank lending.

When the company needs more capital to expand, other sources such as Public-Market Financing can be considered. The company can decide to sell all or part of the business by selling its stocks to the public. Examples of well-known names are some of the world’s biggest companies, such as Apple, JP Morgan, Chase banking, Toyota, and Microsoft, who were established and later expanded by increasing public-market funding.

Utility firms, transportation companies, food and beverage corporations, and telecommunications companies, have entered the Capital Market to finance routine activities and grow their businesses at some point. As a logical result, regulators and shareholders put businesses under more and substantial “scrutiny”.

In these cases, companies had to “surrender” some of their power/ownership and privacy to be able to access these significant sums of money that they could never have acquired from other sources. Although this growth path is appealing and necessary to some firms, others may find that regulators and/or shareholders are scrutinizing public ownership for their own advantage or profit.

Therefore, one of the leading reasons why a corporation may wish to remain anonymous, is that there have fewer transparency standards. In this situation, a corporation is not required to submit audited accounts to a vast number of shareholders, only disclose their operating plans and relevant financial details. While they must of course still conduct correct and modern accounting, they do not have to comply with the stringent and often complicated accounting requirements and regulations that apply to public corporations.

In general, going public can be very costly due to the underwriting and other forms of administrative costs, particularly for smaller companies. In these cases where small and medium-sized private companies are unable to raise money on financial markets, they still have the option to raise capital through traditional or innovative ways of financing. How?

Businesses that have been in operation for a long time have built partnerships with the banks and can tap into commercial credit lines when necessary. This is what is known as the traditional way of financing. They can use their investments or inventories and unencumbered assets as debt collateral for bank financing. In general, it is said that public and private small and medium-sized companies are the backbone of the economy. Therefore, their impact on the economy is substantial when they are well managed.

Recently, we have seen new innovative ways of raising capital. There is the possibility, for certain companies, to organize a crowdfunding activity among existing clients and partners, to obtain the capital they need. There are several formats of crowdfunding, including Equity-Based Crowdfunding which we will discuss later in upcoming publications.

But there is no doubt that if they choose to raise capital on the Stock Market to invest in their company’s growth, there is a direct correlation and often big spinoff to the economic development of the country. In an ideal scenario, the growth of the companies can be accelerated; citizens participate and share in the positive results of these larger companies, which on its turn, creates a leveraged result in income with those citizens, and the circle can go around again.

Final Thoughts

As we mentioned, there is a great opportunity for growth for large private corporations when they go public. If we look at Small and Medium-Sized Enterprises (SMEs), the reality is different. SMEs do not have the same opportunities to enter the Stock Market like larger corporations do. Why?

Many exchanges and regulators globally are focussed on large corporations and therefore have a very high threshold for raising capital when it comes to the participation of these corporations in the Stock Market. Not to mention the exorbitant fees of the listing process, which make it almost impossible for any SMEs to list on an exchange.

At the DCSX we realize that for the international business community to prosper, start-ups as well as SMEs must be in the position to attract capital on a regulated, practically oriented exchange and to do so at fair costs. This means that we offer affordable fees linked to the listing process in comparison to other exchanges globally.

It is this start-up and SME community that the DCSX is focused on service to enable it to:

- Reach its level of maturity to enter the capital market, and

- Eventually enter the Capital Market and raise their needed capital.

The DCSX offers that community a combination of fair costs with a clear and transparent communication and provision of information.

Sources:

Albuquerque de Sousa, J., T. Beck, P.A.G. van Bergeijk, and M.A. van Dijk. 2016. “Nascent markets: Understanding the success and failure of new stock markets” CEPR Discussion Paper. Retrieved from https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2870392

Laeven, Luc, and Fabian Valencia, 2012. “Systemic Banking Crisis Database: An Update,” I.M.F. Working paper. WP/12/163. Retrieved from https://www.imf.org/external/pubs/ft/wp/2012/wp12163.pdf

Sahay, R. et al. 2015. “Rethinking Financial Deepening; Stability and Growth in Emerging Markets”. I.M.F. Staff Discussion Notes 15/08, International Monetary Fund. Retrieved from https://www.imf.org/external/pubs/ft/sdn/2015/sdn1508.pdf

Thorsten Beck, Aslı Demirgüç-Kunt, and Ross Levine, 2000, “A New Database on Financial Development and Structure,” World Bank Economic Review 14, 597-605. Retrieved from https://www.worldbank.org/en/publication/gfdr/data/financial-structure-database

World Federation of Exchanges. 2018. Retrieved from https://www.world-exchanges.org/our-work/statistics

This publication is presented to you by the Dutch Caribbean Securities Exchange

Written by N. Martina. Edited by D. Intriago and R. Römer.

Download the PDF version of this article: EN